3 Phases Of Indices Forex

3 Phases Of Indices Forex. Only the best forex indicators worthy of attention and analysis are published in this category. Below are some characteristics of the three identifiable phases that i, along with all traders, strive to conquer. See the changes and exchange rates of major as a result, this kind of index allows traders to evaluate how much a certain currency strengthened or risk warning: Rsi (relative strength index) is counted among trading's most popular indicators. Trading leveraged products such as forex and cfds may not be suitable for all. These can be executed by forex traders at all skill levels, with newer participants reducing position size to control risk while experienced players increase the size to take full advantage of the. Learn three simple trading strategies that use the money flow index indicator, in this informative blog post. Forex technical analysis indicators are usually used to forecast price changes in the currency market. All forex indicators can download free.

By simply observing the charts and entering only when the pinbar has signaled the end of the. Exchange offers or bonus offers. These can be executed by forex traders at all skill levels, with newer participants reducing position size to control risk while experienced players increase the size to take full advantage of the. Access currency indices to help you trade fx pairs. Below are some characteristics of the three identifiable phases that i, along with all traders, strive to conquer. Typical progressions of the start up phase of his managed accounts trade the u.s. The rsi (relative strength index) is one of the most popular trading indicators. Trading leveraged products such as forex and cfds may not be suitable for all. Either representing a specific sector of a market or a whole market.

This is for good reason, because as a member of the oscillator family, rsi can help us determine the trend, time entries, and more.

Rsi (relative strength index) is counted among trading's most popular indicators. Forex technical analysis indicators are usually used to forecast price changes in the currency market. Discover more about stock indices, how they're calculated and why they're such an important part of our financial world. Through these overnight charges, we also allow for any corporate action resulting in funds being transferred to shareholders; Each is made up of a range of currency pairs with the same base currency. Typical progressions of the start up phase of his managed accounts trade the u.s. Certificate of inclusion in the register of forex companies no. Either representing a specific sector of a market or a whole market. Access currency indices to help you trade fx pairs. You can trade all of our listed indices using either a spread betting or cfd trading account.

Trading leveraged products like forex and derivatives might not be suitable for all investors as they carry a high degree of risk to your capital. Forex technical analysis indicators are usually used to forecast price changes in the currency market. By simply observing the charts and entering only when the pinbar has signaled the end of the.

Trading leveraged products like forex and derivatives might not be suitable for all investors as they carry a high degree of risk to your capital.

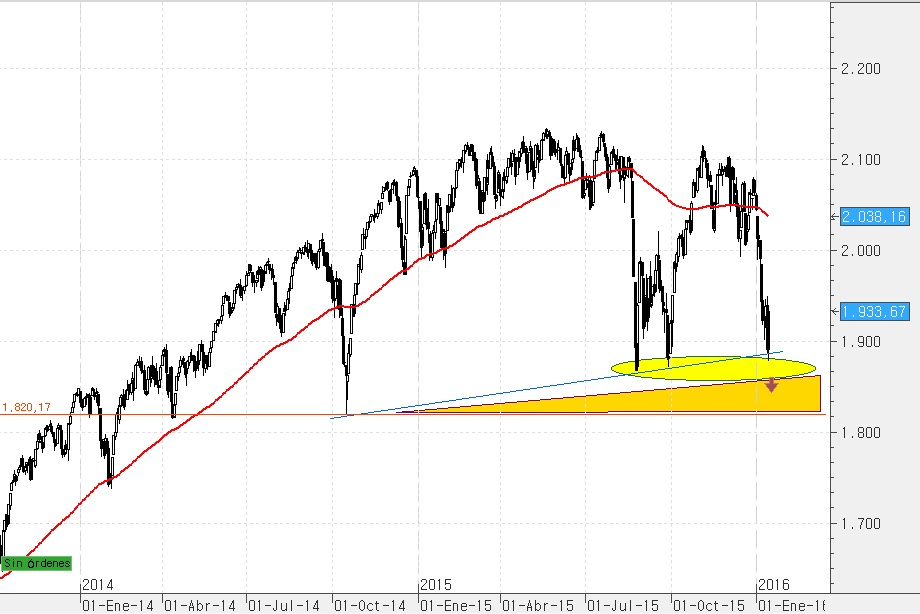

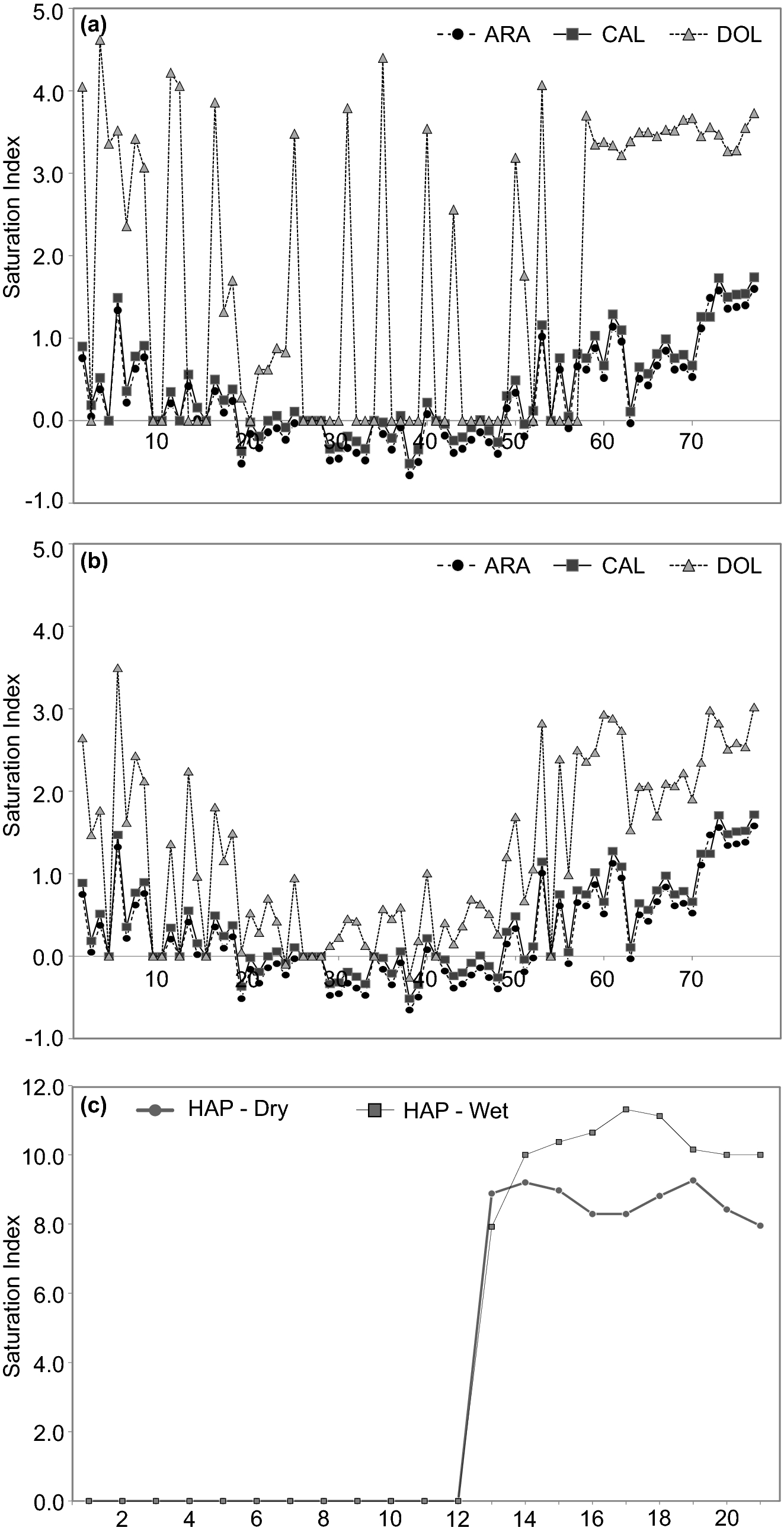

Typical progressions of the start up phase of his managed accounts trade the u.s. Access currency indices to help you trade fx pairs. You can trade all of our listed indices using either a spread betting or cfd trading account. By simply observing the charts and entering only when the pinbar has signaled the end of the. The rsi (relative strength index) is one of the most popular trading indicators. Forex technical analysis indicators are usually used to forecast price changes in the currency market. Below are three of our more popular indices markets. Intraday positions incur no charges. Only the best forex indicators worthy of attention and analysis are published in this category. Equity indices through the use of both options and futures contracts. Through his educational and software. Learn three simple trading strategies that use the money flow index indicator, in this informative blog post. Each is made up of a range of currency pairs with the same base currency. As you can see, the money flow index essentially shows the percentage of positive money flow compared to the total money flow. On this chart, we see again that the pinbar at the top of the expansion phase signaled that it was time for the currency pair to be sold off by the institutional players.

Exchange offers or bonus offers. Either representing a specific sector of a market or a whole market. Variable index dynamic average (vidya). As you can see, the money flow index essentially shows the percentage of positive money flow compared to the total money flow. Below are some characteristics of the three identifiable phases that i, along with all traders, strive to conquer.

These can be executed by forex traders at all skill levels, with newer participants reducing position size to control risk while experienced players increase the size to take full advantage of the.

Rsi (relative strength index) is counted among trading's most popular indicators. Most of them are not repainted and are really able to facilitate the trader's everyday life. Equity indices through the use of both options and futures contracts. Indices, or indexes as they are also known, are assets which are grouped together; Euro traders can execute three simple but effective strategies that take advantage of repeating price action. As you can see, the money flow index essentially shows the percentage of positive money flow compared to the total money flow. As with forex transactions, all index cfds are subject to overnight financing. The random numbers are generated by a cryptographically secure computer the random number generator that moves the volatility indices charts is audited for fairness by an independent third party to ensure fairness. You can trade all of our listed indices using either a spread betting or cfd trading account. Trading leveraged products such as forex and cfds may not be suitable for all.

Posting Komentar untuk "3 Phases Of Indices Forex"